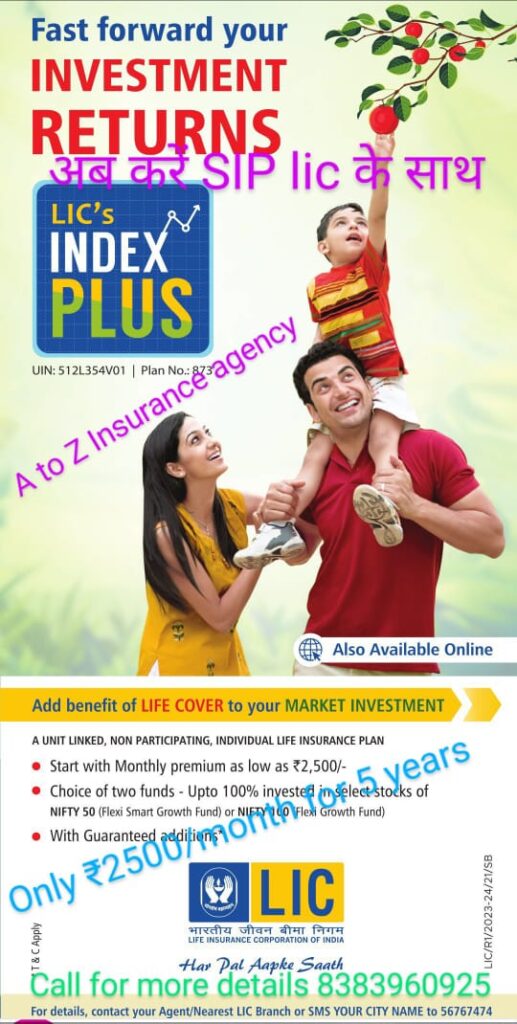

Key Benefits of LIC SIP-like Plans:

1-Life Cover: Provides financial security to your family in your absence is 10 time of your annual premium . 2- Savings and Investment: Helps in systematic savings and wealth creation over time. 3-Tax Benefits: Premiums paid are eligible for tax deductions under Section 80C, and maturity proceeds are tax-free under Section 10(10D). 4- locking period : is only 5 years means you can withdraw your fund any time after 5 year. 5- minimum premium : start from 2500rs /month minimum. 6- GST : No extra GST on . 7- Age limit: From 90 days to 60 year all gender can purchase it.