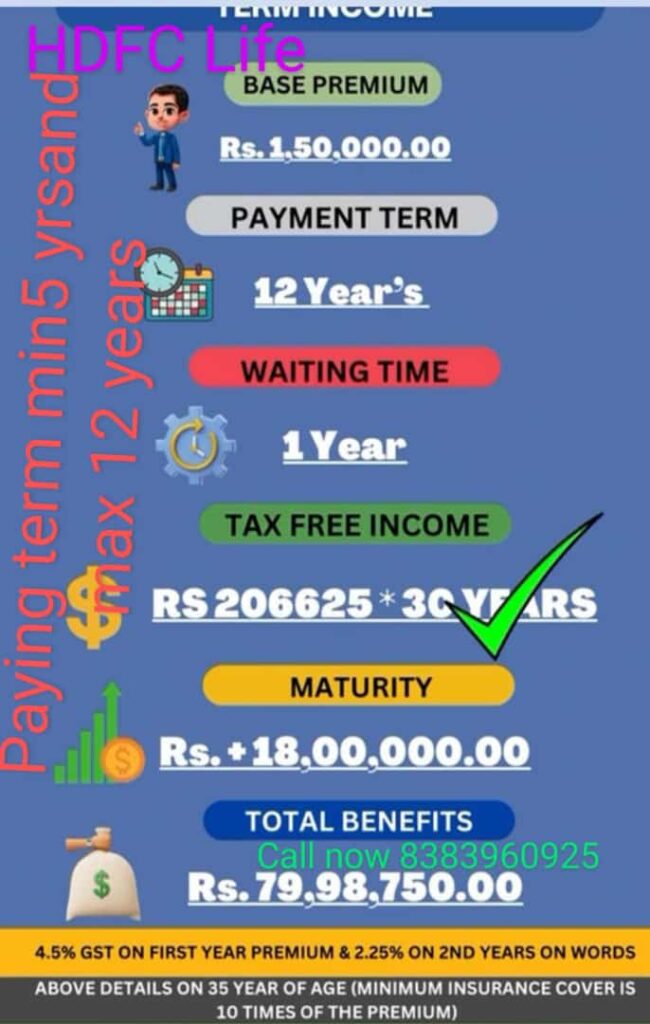

you can change the paying term and premium accordingly your budget in avobe plan

Guaranteed return plans with life insurance provide a combination of risk protection and assured returns, making them an attractive option for individuals seeking financial stability and security. Here are some key points highlighting their importance:

1. Financial Security for Dependents

- Life Coverage: The primary benefit is life insurance coverage, ensuring that the policyholder’s dependents receive a sum assured in the event of their untimely demise. This helps maintain their standard of living and covers expenses like education and daily living costs.

- Guaranteed Returns: These plans offer guaranteed returns at maturity, providing financial security and predictable outcomes, unlike market-linked plans that carry investment risk.

2. Steady Income Stream

- Assured Payouts: Many guaranteed return plans offer regular payouts after a certain period, providing a steady income stream which can be particularly beneficial post-retirement or for funding significant future expenses.

3. Risk-Free Investment

- Capital Protection: The premiums paid are generally invested in safe instruments, ensuring the protection of the capital and eliminating the risk of loss.

- Predictable Returns: Policyholders know the exact amount they will receive at maturity, making it easier to plan for future financial goals.

4. Tax Benefits

- Tax Deductions: Premiums paid towards these policies are often eligible for tax deductions under Section 80C of the Income Tax Act.

- Tax-Free Payouts: The maturity benefits and death benefits received are generally tax-free under Section 10(10D), subject to specific conditions being met.

5. Long-Term And Short Term Savings Discipline

- Regular Premium Payments: These plans require regular premium payments, instilling a disciplined savings habit which is crucial for long-term financial planning.

6. Wealth Accumulation

- Compounded Growth: Over time, the premiums paid into these plans grow through guaranteed additions, bonuses, or other benefits, leading to significant wealth accumulation by the end of the policy term.

7. Flexibility and Customization

- Variety of Plans: Insurers offer a range of guaranteed return plans tailored to different financial needs and life stages, allowing policyholders to choose plans that best align with their financial goals.

- Optional Riders: Additional riders for critical illness, accidental death, or disability can be added to enhance the coverage and benefits.

8. Peace of Mind

- Reliability: Knowing that the policy will provide a guaranteed return gives peace of mind to policyholders, as they do not have to worry about market volatility or financial uncertainties affecting their returns.

Conclusion

Guaranteed return plans with life insurance offer a prudent way to ensure financial protection for loved ones, coupled with assured returns that help in achieving long-term financial goals. Their risk-free nature, coupled with tax benefits and disciplined savings, makes them a vital component of a well-rounded financial plan. thanks G.D.Pandey (teem a to z insurance )call for more detials 8383960925