BOUT NEW ULIP PLAN PROTECTION PLUSL A new ULIP (Unit Linked Insurance Plan) named “Protection PlusLIC” — possibly a recently launched plan by the Life Insurance Corporation of India (LIC).

🛡️ Overview of a ULIP Plan Like “Protection Plus LIC”

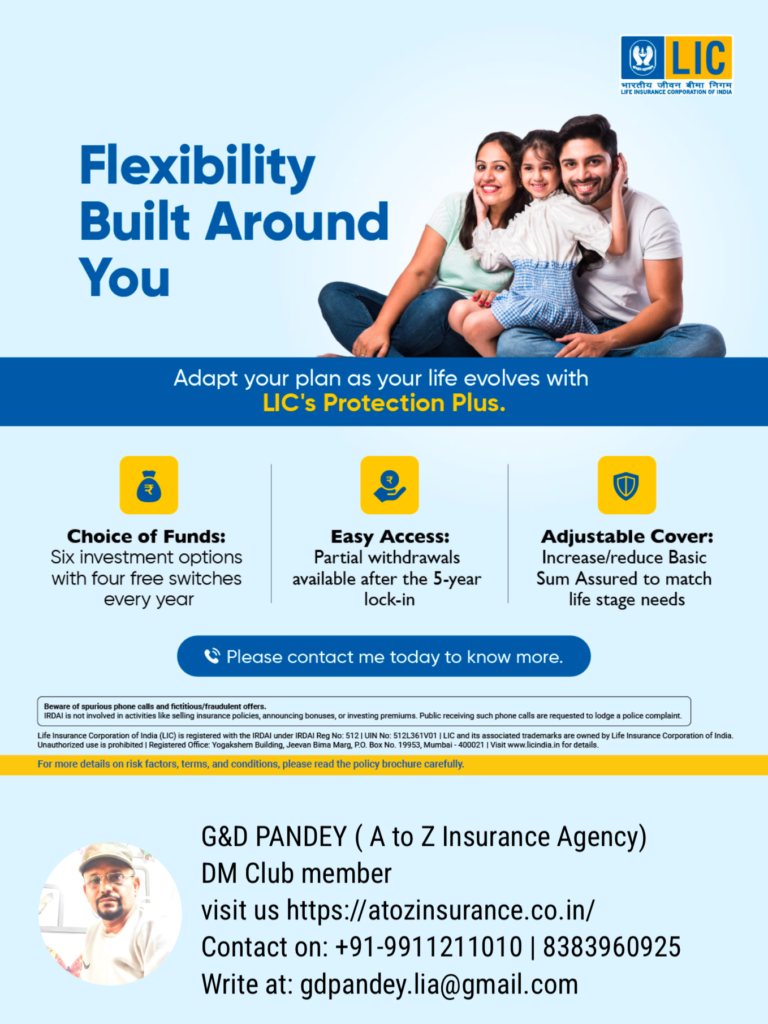

A ULIP combines life insurance coverage with investment opportunities in equity and debt markets. Plans like Protection Plus generally focus on giving policyholders both security and wealth creation.

🌟 Key Features (Expected):

-

Dual Benefit:

- Protection: Life cover UP TO 40 TIME OF ANUAL PREMIUM throughout the policy term.

- Investment: Part of your premium goes into market-linked funds (equity, debt, or balanced).

-

Flexible Premiums:

- You can choose premium amounts, payment frequency, and investment strategy.

-

Fund Options:

- Usually offers multiple fund choices such as Growth Fund, Balanced Fund, Bond Fund, etc.

-

Switch Option:

- Switch between funds based on your market outlook or risk preference.

-

Partial Withdrawals:

- After a lock-in period (typically 5 years), you can make partial withdrawals if needed.

-

Tax Benefits:

- Premiums may qualify for deductions under Section 80C, and maturity/death benefits may be exempt under Section 10(10D) (subject to current tax laws).

-

Death & Maturity Benefits:

- Death Benefit: Sum assured + fund value (or higher of the two).

- Maturity Benefit: Fund value upon completion of policy term.

📈 Who It’s For:

- Individuals looking for a balance between protection and market-linked returns.

- Ideal for long-term wealth creation—like children’s education, retirement corpus, or asset building.

⚠️ Points to Remember:

- Returns are market-linked, not guaranteed.

- Consider fund management & policy charges.

- Stay invested for at least 5 years to avoid exit penalties.