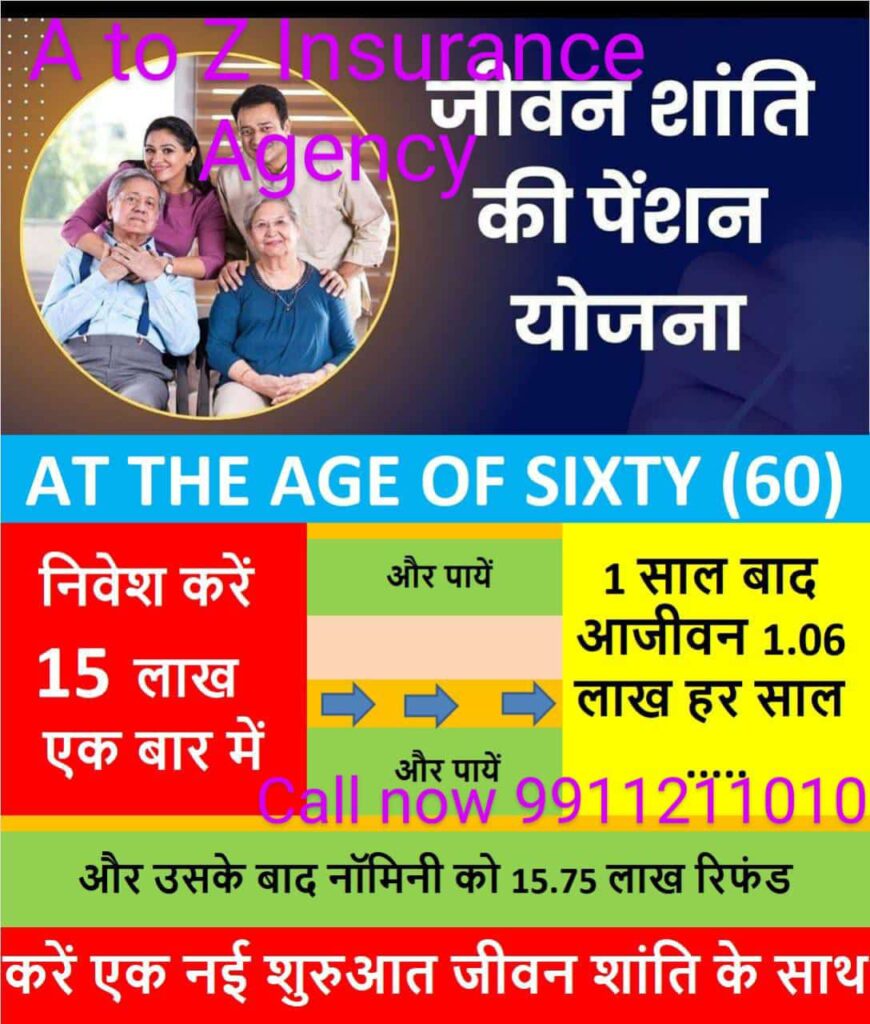

The Jeevan Shanti Plan (Plan No. 758) by LIC (Life Insurance Corporation of India) is a popular single premium annuity plan, providing options for both immediate and deferred annuity. This plan offers a guaranteed income (pension) for life after a one-time premium payment, making it an attractive option for retirement planning.

Key Features of LIC’s Jeevan Shanti Plan:

-

Single Premium Payment:

- You pay a lump sum at the start, and in return, you receive a guaranteed annuity (pension) for life.

-

Two Types of Annuity Options:

- Immediate Annuity: The pension starts immediately after paying the premium.

- Deferred Annuity: The pension starts after a chosen deferment period (from 1 to 20 years), with an enhanced annuity benefit due to the deferment.

-

Annuity Options: There are multiple annuity options under Jeevan Shanti:

- Lifetime annuity (Annuity for life)

- Lifetime annuity with a return of purchase price

- Lifetime annuity for a fixed period (5, 10, 15, or 20 years) and life thereafter

- Joint life annuity (for policyholder and spouse), and others.

-

Deferred Annuity Advantages: If you choose the deferred option, your annuity will increase with a longer deferment period, making it more lucrative for those who don’t need immediate income.

-

Death Benefit: Depending on the option selected, the nominee may receive a death benefit such as a return of the purchase price or other specified payments in the event of the policyholder’s death.

-

Loan and Surrender Options: After a certain period (one or two years depending on the annuity option), the policyholder can avail of a loan against the policy. Some options also allow surrender, where a percentage of the purchase price can be refunded in certain circumstances.

Benefits:

- Guaranteed Income: Provides financial security by ensuring a fixed income for life.

- Customizable: Various annuity options make it suitable for different financial needs and preferences.

- Tax Benefits: Premiums paid may be eligible for tax benefits under Section 80C of the Income Tax Act.

This plan is typically used by individuals planning for retirement, as it provides a steady and guaranteed stream of income, ensuring financial security in the later stages of life. G.D.PANDEY (Founder of A to Z Insurance Agency)